Introduction – the Startup Act Process

Cabo Verde, a nation of ten islands, namely Santiago, Santo Antão, São Vicente, São Nicolau, Sal, Boa Vista, Maio, Fogo, Brava, and Santa Luzia, is undertaking significant step towards creating a conducive business environment to promote startup growth. The Government of Cabo Verde, through the Ministry of Digital Economy and Cabo Verde Digital, with support from the World Bank, is in the process of developing a comprehensive Startup Act for Cabo Verde. Collaboration with i4Policy and Miranda & Associados has brought forward a participatory policy design process, from hands-on policy hackathons on three islands to a deep dive into ecosystem benchmarking. The benchmarking exercise resulted in a report, which is available for download at the end of the article.

This report offers an in-depth look at Cabo Verde’s entrepreneurial environment, evaluating its regulatory setting, ecosystem strengths, and practical recommendations to guide the Startup Act’s development. The objective is to deliver actionable insights for building a vibrant, inclusive, and globally competitive startup ecosystem.

Benchmarking Analysis using the Africa Entrepreneurship Ecosystem Index (AEEI)

Drawing on the Africa Entrepreneurial Ecosystem Index (AEEI), conversations with stakeholders, and survey responses, this review sets Cabo Verde’s ecosystem against top-tier African countries, fellow Lusophone nations, and West African peers, focusing on its legal and policy environment, ecosystem performance, and actionable recommendations.

The comparison spans seven essential dimensions: Governance, Culture, Support, Finance, Infrastructure, Market Access, and Human Capital.

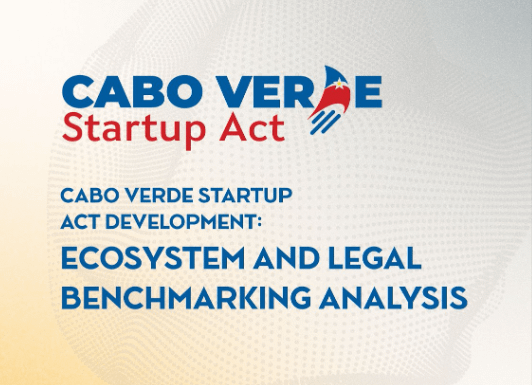

Benchmarking With Top AEEI Performers

Top performers on the AEEI include Mauritius, South Africa, Tunisia, Morocco, with Cabo Verde placing fifth (5th). Cabo Verde excels in governance, achieving one of the highest scores (0.93–0.95) in the region due to its political stability and regulatory clarity. However, bureaucratic inefficiencies and delayed policy implementation often undermine these strengths.

In support, the country shows moderate progress (score: 0.54), with the development of incubation spaces and youth programmes, but still lags behind leaders like Mauritius, particularly in programme effectiveness and internationalisation.

On the other hand, finance (0.21) and market access (0.16) are major bottlenecks. Startups struggle with limited access to early-stage funding and constrained opportunities to scale due to a small domestic market and weak trade links.

Source: i4Policy representation based on AEEI-data

Culturally, Cabo Verde faces significant challenges, with a low culture score of 0.21. Risk aversion, stigma around failure, and limited societal support for entrepreneurship hinder the development of a vibrant startup culture.

While infrastructure is moderately developed (0.61), digital advancements contrast with lagging physical infrastructure, such as transport and logistics. Overall, while Cabo Verde has a strong institutional foundation, it must address cultural, financial, and market barriers to fully realise its entrepreneurial potential.

Cabo Verde demonstrates moderate strength in human capital, with a score of 0.57. The country benefits from high literacy rates and educational attainment; however, a gap remains in vocational, technical, and entrepreneurial training. Addressing this skills gap is essential to meet the demands of a modern, innovation-driven startup economy.

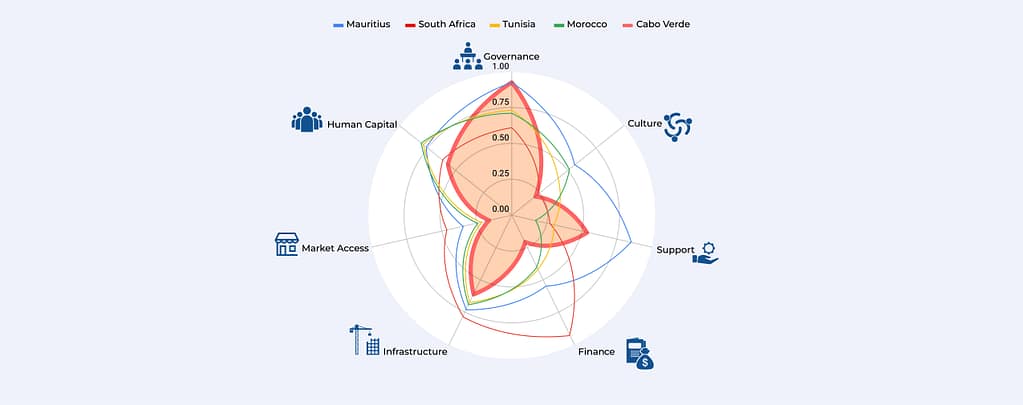

Comparison with Lusophone Africa

When compared to other Lusophone African countries, Cabo Verde leads in governance, infrastructure, support, and human capital. See figure 2 for comparative performance against Lusophone countries.

Source: i4policy based on AEEI

Its governance score is notably higher than those of Angola, Mozambique, Guinea-Bissau, and São Tomé and Príncipe, reflecting strong political stability and institutional effectiveness. However, finance and market access are weak points not only for Cabo Verde but also for its Lusophone peers, as all face limited access to venture capital and challenges in expanding their market reach.

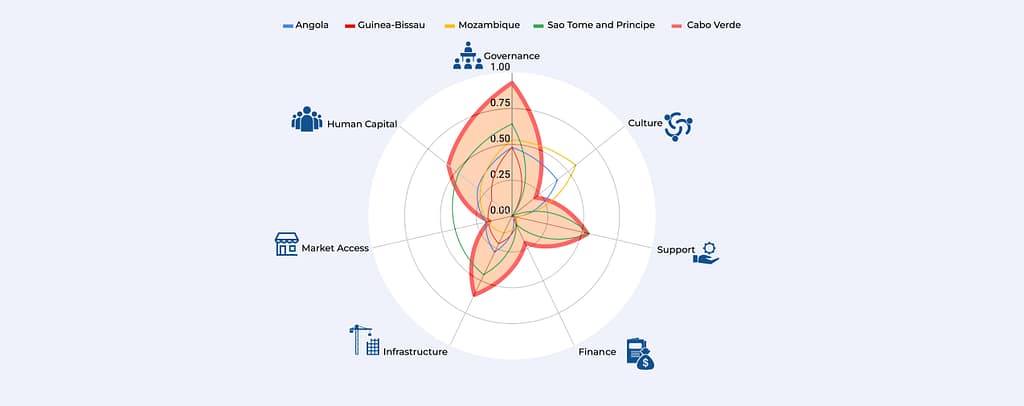

Comparison with West African Countries

Among West African neighbours, Cabo Verde stands out in governance and infrastructure, while Senegal outperforms in entrepreneurial culture and finance. Market access remains a universal challenge in the region, underscoring the importance of regional trade platforms and cross-border marketplaces. Figure 3 below illustrates the performance of Cabo Verde compared to six other West African countries.

Source: i4policy based on AEEI

Legal and Policy Environment

Cabo Verde’s legal and policy framework for entrepreneurship is robust, featuring streamlined business registration, digital one-stop shops, and investor-friendly processes. We have seen great initiatives such as ZEET and the Digital Technology Park position Cabo Verde as a potential regional technology hub, comparable to innovation hubs in Rwanda and Ghana. Financial instruments like Pro Garante and Pro Capital have improved credit access, while incubation laws and youth entrepreneurship programmes provide a supportive base for new ventures. Despite these advances, finance and market access remain underdeveloped, with limited access to venture capital and a small domestic market posing challenges for scaling startups. These are some gaps the Act should address.

Insights from the Ecosystem: Survey and Stakeholder Insights

Note: this section is based on a survey of entrepreneurs across the islands and from policy hackathons organised in three islands – Sal, São Vicente, and Santiago. It also involved speaking to stakeholders across the islands, as well as in the diaspora. Although based on a limited number of respondents, it could lay the foundation for an expanded survey.

Physical and digital connectivity remain a challenge for entrepreneurs across the islands. This has implications for entrepreneurial development engagements among entrepreneurs and service providers across the islands. Based on stakeholder engagements, the entrepreneurial landscape across Cape Verde’s main islands (Santiago, São Vicente, Sal, and Santo Antão) reveals notable variations in suitability and performance across seven critical dimensions: Governance, Culture, Support, Finance, Infrastructure, Market Access, and Human Capital.

Cabo Verde’s business governance and legislative environment is characterised by excessive bureaucracy, inefficient and overlapping administrative processes, and the absence of a streamlined centralised ‘one-stop shop’. Entrepreneurs face high procedural costs and encounter legal frameworks that are often misaligned with local realities and emerging sectors like technology and green innovation. The registration system for micro and small enterprises (REMPE) is seen as adding complexity rather than simplifying formalisation. Additionally, entrepreneurs struggle with unclear, inaccessible legal information and lack of awareness about relevant regulations, while limited market research and structured insights further hinder their ability to align business strategies with prevailing laws. These challenges underscore the urgent need for more responsive, coordinated, and accessible public policies to support entrepreneurship in the country.

Island-by-Island Entrepreneurial Landscape

Santiago and São Vicente emerge as the most favourable environments for entrepreneurship, benefiting from strong governance, advanced infrastructure, comprehensive support systems, and a robust pool of skilled talent. These islands, especially Santiago with its TechPark and government presence, provide efficient public institutions, digital services, and access to training and funding initiatives, positioning them as the country’s leading innovation hubs.

In contrast, Sal and Santo Antão face more pronounced obstacles, particularly in finance, infrastructure, and market access. Sal’s ecosystem is shaped by a conservative culture and a focus on tourism, resulting in limited diversification, weaker support mechanisms, and slower human capital development. Santo Antão, while resource-constrained, stands out for its supportive local culture and effective community-level mentoring, but struggles with basic infrastructure, limited financial options, and small market size. Both islands rely heavily on informal networks and community-driven initiatives to compensate for gaps in formal support and investment.

Across all islands, market access remains a universal constraint due to the small domestic market and geographic isolation, prompting many entrepreneurs to seek opportunities in regional or international markets. While Santiago and São Vicente are better positioned for external engagement, all islands would benefit from targeted policy interventions to address persistent barriers in finance, infrastructure, and cultural attitudes toward entrepreneurship. Leveraging the strengths of Santiago and São Vicente, while investing in the specific needs of Sal and Santo Antão, will be essential for fostering a balanced and inclusive entrepreneurial ecosystem throughout Cape Verde.

Island Performance Overview

| Island | Governance | Support | Infra- structure | Finance | Market Access | Human Capital | Culture |

| Santiago | Strong | High | Advanced | Moderate | Limited | Robust | Improving |

| São Vicente | Strong | Solid | Good | Moderate | Limited | Robust | Developing |

| Sal | Weaker | Limited | Needs support | Low | Limited | Developing | Conservative |

| Santo Antão | Supportive | Good | Resource-limited | Low | Limited | Strong | Positive, local |

Recommendations and Strategic Priorities for Cabo Verde’s Startup Act

To strengthen Cabo Verde’s entrepreneurial ecosystem, the Startup Act should adopt an inclusive strategy focused on improving access to finance, simplifying regulations, and fostering innovation. Key measures include establishing crowdfunding and diaspora investment platforms, offering tax incentives and co-investment funds, promoting alternative finance options, and streamlining business registration through digital tools. Investments in digital infrastructure, technology parks, and the blue economy will help position Cabo Verde as a regional hub for innovation and logistics. Regional integration via ECOWAS and AfCFTA, favourable visa regimes, and regulatory harmonisation are also essential. Inclusivity should be ensured through decentralised funding, support for underrepresented groups, and clear implementation timelines with independent monitoring.

Island-level performance varies significantly. Santo Antão leads in human capital, governance, and ecosystem support, providing best practices for nationwide replication. Sal and São Vicente face major gaps in infrastructure, finance, and entrepreneurial culture. Across all islands, challenges like limited market access and risk-averse mindsets persist. To overcome these challenges, the country must invest in inter-island knowledge sharing, improve infrastructure and startup training, simplify financing and policy processes, and foster a more positive cultural outlook on entrepreneurship.